Timeshare Tourism

They’ve engaged very well with vacation owner-

ship, too. “General tourism is the bread and butter

for Phuket,” says Hickman. “It’s among the top four

tourist destinations in Thailand, along with Bangkok,

Pattaya, and Chiang Mai, and probably ranks num-

ber three after Bangkok and Pattaya.”

In terms of timeshare, though, Hickman says

Phuket leads the list. For starters, there are simply

more vacation ownership opportunities in Thailand than anywhere else

in Southeast Asia. In 2015, C9 Hotelworks, a Phuket-based hospitality

consultancy, identified 154 timeshare properties peppered throughout the

region. Thirty-five percent of those, by far the largest concentration, were

located in Thailand.

And most of those are in Phuket, Hickman says: “There are more

resorts actively engaged in vacation ownership there than any other

destination in Asia.” The concept was introduced in Thailand nearly a

quarter-century ago, and “much like Orlando, Phuket attracts visitors from

around the world who typically stay for long holidays — one- to two-week

minimums — so there are a lot of opportunities to speak to prospects,”

Hickman adds.

In addition, for the majority of those 25 years, prospects have been

exposed to some of the foremost developers in the industry. “The larg-

est and best purpose-built vacation ownership projects in Asia were first

established in Phuket by the likes of Marriott, Laguna, and Anantara, thus

timesharing gained momentum quicker here than places that only have

small resorts with relatively few units,” says Hickman.

Upward Mobility

And like Phuket tourism itself, the timesharing momentum seems poised

to continue its upward trend. “The concept is relatively new tomost Asians,

but they are embracing it, so future prospects for the business are bright,”

Hickman says. In other words, there are countless consumers out there

waiting to learn about the joy of vacationing at a fully

amenitized resort property.

The most promising piece of the current sales

puzzle is that the majority of potential purchasers are

now coming from new buyer markets. The Tourism

Authority of Thailand has reported that, from January

through April of 2016, 14.1 percent more people

traveled to Thailand than during the same period

in 2015. The largest collection of visitors — with an

increase of more than 27 percent — hails from China.

This all makes sense to Hickman because of recent socio-economic

improvements and the burgeoning middle class there, as well as in other

nearby countries. “Timeshare is quickly gaining popularity, especially in

China and India,” he says. “India currently has more timeshare owners

than most of the other Asian countries combined, so while not a com-

pletely new concept, the ability of the middle-class population to afford

timeshare is very new.”

Previously, developers in well-known resort areas such as Phuket and

Bali only targeted Western prospects, says Hickman, “But, because of

these emerging consumer populations, they now have salespeople who

speak Mandarin, Bahasa Indonesia, and more, so they can sell to people

they previously didn’t market to because of language barriers.”

Communication challenges or not, Interval International has been in

operation in Thailand and throughout Asia for at least 25 years, and is affil-

iated with the region’s major timeshare brands. “Anantara was our latest

big affiliation in Phuket,” Hickman says. “That group alone now has more

than 7,000 members.”

With new affiliations and a seemingly endless supply of new consum-

ers flowing into Thailand from fresh markets, it shouldn’t be a surprise that

Hickman calls Phuket “undoubtedly the most important market for Interval

in Asia at this time.”

Indeed, the future of timeshare in Phuket appears very promising, so

Hickman’s final piece of advice is simply: “Build it and they will come.”

Be sure to read the features on two other developers with properties in Phuket:

Angsana Vacation Club, on page 28, and Club Unique, on page 30.

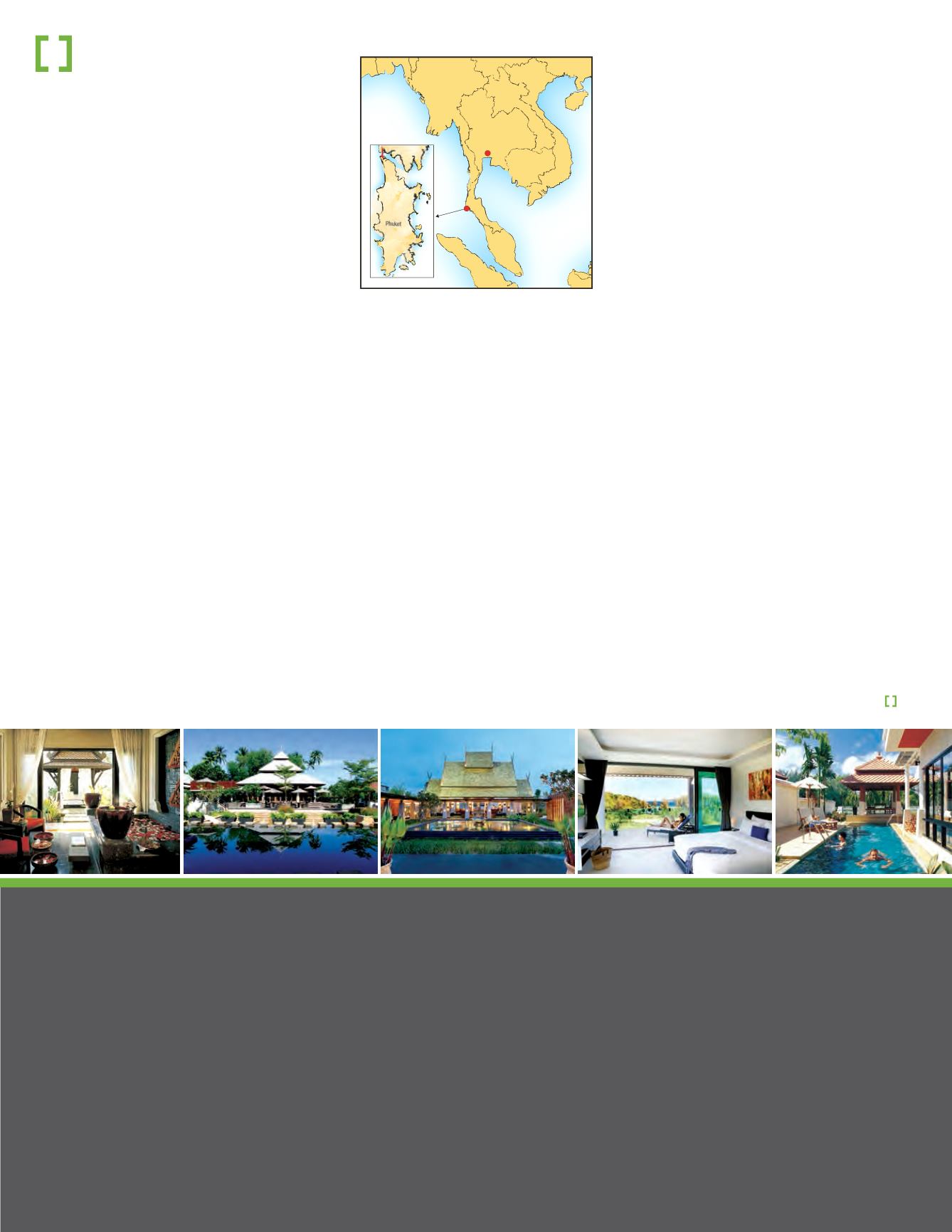

Marriott’s Phuket Beach Club (1)

Thanks to well-kept gardens and tranquil ponds adorned with lilies, not to mention

swimming pools facing the Andaman Sea, this resort property allows guests to truly feel

at one with Phuket’s natural beauty.

Marriott’s Mai Khao Beach (2)

In addition to an assortment of comfort-enriching features — such as master suites with

an oversized tub in the bathroom, individual outdoor seating, and more — this resort is

situated less than 1,000 feet (305 meters) from Mai Khao beach.

Anantara Vacation Club Phuket Mai Khao

(3)

This property is adjacent to Sirinath National Park, so while Phuket’s longest beach, Mai

Khao, is an easy walk away, the park’s unique natural features —mangrove forests, sea

caves, and peaceful atolls — also are easily accessible.

Absolute Twin Sands Beach Resort & Spa

(4)

Couples and families all appreciate the Absolute Twin Sands Beach Resort & Spa. It’s

situated close to Patong, so shopping and nightlife are nearby, and the infinity pools and

spa are popular with folks who simply want to recharge.

LHC Private Pool Villas

(5)

LHC Private Pool Villas is one of the resorts that make up the entirety of the Laguna

Phuket complex.There’s an on-site golf course, but for many guests, the highlight of their

stay is the availability of the 30 restaurants and bars.

LHC at Angsana Laguna Phuket

Located in the famed Laguna Phuket complex, the resort offers guests a variety of places

to eat or get a drink. Optional on-site activities abound, too. Sailing, scuba diving, and

waterskiing are very popular.

A Sampling of Interval International–Affiliated Phuket Resorts

Malaysia

Indonesia

Malaysia

Cambodia

Thailand

Bangkok

Andaman

Sea

Phuket

Singapore

China

Vietnam

Myanmar

Laos

Phuket

1

2

3

4

5

MARKET

SPOTLIGHT