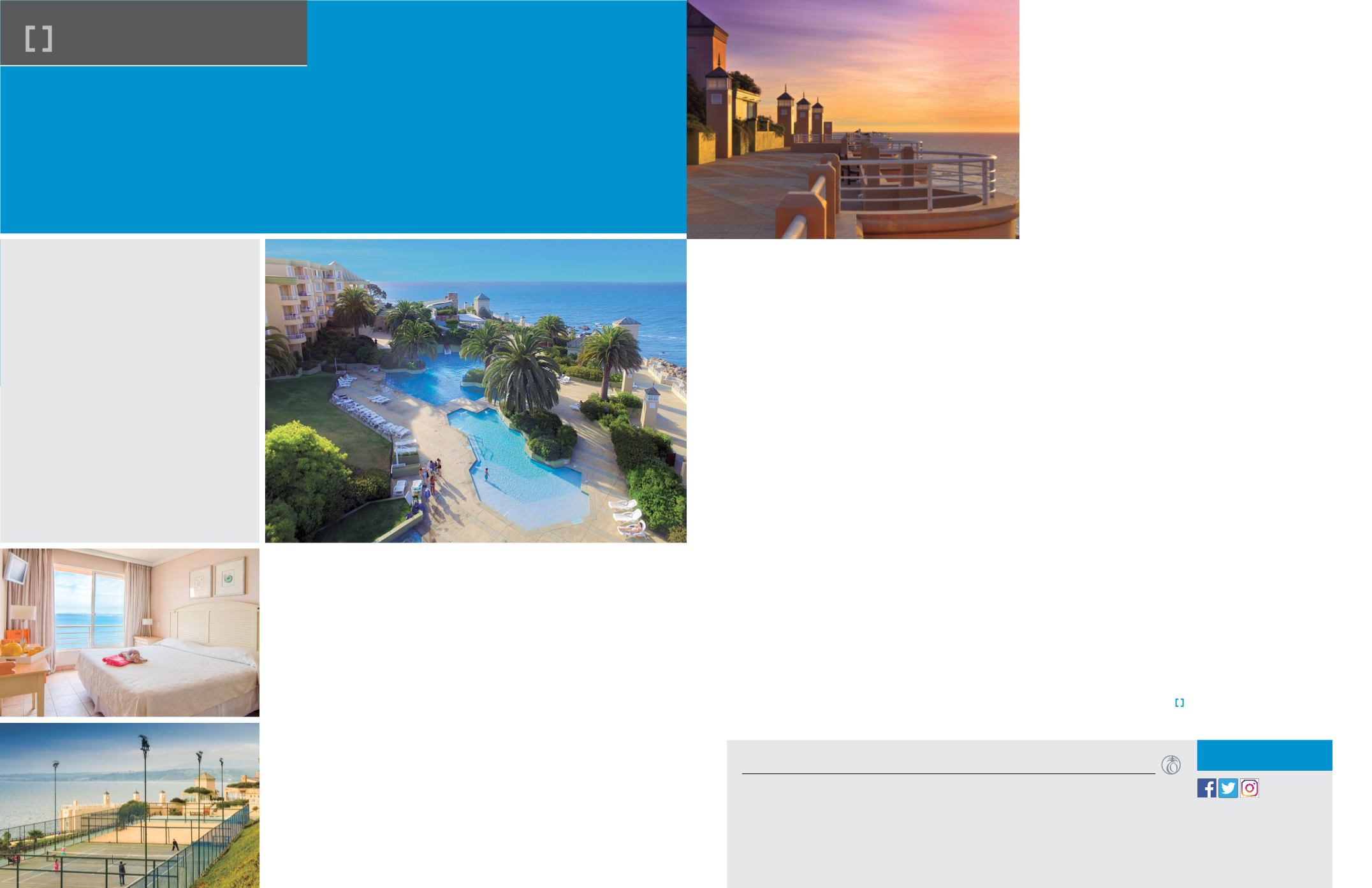

the lushly landscaped resort offers indoor and outdoor pools, a

sauna, a gym, tennis courts, a minimarket, and a restaurant serving

international cuisine.

Nearby is the famous Casino de Viña del Mar, which presents

sought-after entertainment year-round. Valparaíso, a UNESCO World

Heritage site and seaport, is a 30-minute drive from the resort; the ski

region of Portillo is a three-hour drive away.

Outlook for Chile

Sales were brisk from the start, with units purchased mainly by Chileans,

who make up 95 to 98 percent of owners. Chile has one of the strongest

economies in South America, with residents who vacation frequently and

love beach destinations in particular, Soza says. The resort is close to Viña

del Mar, which Soza describes as “the most important beach in Chile.”

“Since the 1990s, Chile has earned a reputation for being the best-

managed economy in Latin America,” according to a 2017 article in

Forbes

. “Policymakers built up strong institutions, developed new

industries that helped foster more than two decades of impressive

growth,” the article reports. Though the writer notes that there is some

political unrest and a slight slowing of the economy, the

Forbes

article

is generally optimistic.

That optimism extends to the tourist industry. “In 2017, Chile’s per-

formance continues to be on the up,” according to a November 2017

analysis by

ehotelier

. As of August, 4.3 million international travelers

have visited Chile. That’s an 18.3-percent increase in relation to record-

breaking 2016.

Market Opportunities and Sales Strategies

The developer initially pursued the Argentinian market, but because of

economic and political difficulties there, Soza says they decided

to remain focused on the Chilean population. “We realized about

2 percent of our customers would be Argentinian and that most of our

sales would be local.”

Chile’s robust economy provides a healthy market to pursue,

according to Soza. Most of the population is concentrated in Santiago,

the capital city, which is 75 miles (120 kilometers) from the resort,

where fully 40 percent of Chileans live.

“It’s a small, but mostly affluent, market,” Soza says. With a

population of nearly 18 million, Chile is much smaller than Argentina

(population 43.85 million) and Brazil (population 207.7 million). “We are

concentrated on upper-middle-class Chilean buyers who live within

150 miles of the resort,” Toro explains. “Our estimation is that about

227,000 families will be potential buyers.”

The developer originally maintained several off-premises sales

offices, but gradually closed them to shift its attention to on-site sales.

“We realized that our closing rates were much higher at the resort, so

we closed our sales centers in the malls,” Soza says.

One off-premises site in Santiago remains, but the bulk of leads

comes from mini-vacs, including a private vacation program called

Romantic Break. Other marketing tools include social media, referrals,

telemarketing, and search engines such as

Booking.comand Expedia.

Something to Celebrate

Plans are in place for a formal celebration of Hippocampus Viña del

Mar Resort & Club’s 20th anniversary this spring, with cocktail parties

for the owners, employees, stakeholders, and elected officials from the

entire region.

But first, the principals would like to see their new additions

completed. They include a new outdoor swimming pool and facilities

building — with an event room and a spa — and 10 new units.

In late 2017, Soza anticipated that the projects will be completed in

spring 2018. He points out, “You can’t do any construction during the

high season,” which runs from December to March.

Past and Future

Once the anniversary milestone has passed, the developer will embark

on the next project. “Considering the inventory constraint, due to a

good sales level, we are planning to build a new resort in Chile,” Soza

confirms. Site selection — tricky and vital to the project’s success — is

scheduled to begin in the first half of 2018. Other details were still being

roughed out late last year.

“We could build further to the north, which has higher tempera-

tures year-round,” as it’s closer to the equator, Soza explains. “But it

has an even smaller market. If we build closer to Santiago, the market

is much larger.”

Whatever location is chosen, Interval will remain the exchange

partner of choice, Soza says. “Chileans are traveling around the world

a little more every year. We put exchange strategy into the main part

of our sales presentation, because our prospects are very interested

in taking advantage of great opportunities to exchange their points to

travel to other tourist destinations. Interval has been our partner since

the beginning and surely adds an important value to our product.”

“We couldn’t bemore pleasedwith our relationshipwith Hippocampus

Viña del Mar,” says Marcos Agostini, Interval’s executive vice presi-

dent of global sales and business development. “Juan Ignacio Soza

and partners have a long-established relationship with Interval and a

shared commitment to quality.”

RESORT PROFILE

HIPPOCAMPUS VIÑA DEL MAR

RESORT & CLUB

43

Juan Ignacio Soza and his partners

pride themselves on their research

skills and ability — with a little

prescience thrown in — to read

the market. And for that, they can

hardly be blamed:

Hippocampus

Viña del Mar Resort & Club

marked its 20-year anniversary in

November 2017, and is extending

the celebration well into 2018,

amid strong sales — and plans to

add a second property.

BY CATHERINE LACKNER

Expanding on a

Firm Foundation in Chile

Hippocampus Viña del Mar Resort & Club

AN INTERVAL INTERNATIONAL SELECT RESORT

®

Developer:

Inmobiliaria Hippocampus Viña Del Mar S.A.

Location:

Viña del Mar, Chile

Product:

Points-based, right-to-use 11-year term

Units:

92 two-bedroom, two-bath lock-off units

Price:

From US$7,000 to US$10,700, depending on season

Website:

hippocampus.clFAST FACTS

Starting on the Right Foot

In 1995, when Soza — president and owner of Hippocampus Viña del Mar Resort

& Club — first contemplated building a resort, he and his partners visited timeshare

properties in the U.S. “We decided to build 100 two-bedroom lock-off units,” says

Soza. “We took from the industry that this configuration was to be the future.”

They also investigated what was then a new way of selling. “Very few developers

were using the points system at that time; it wasn’t too popular,” he says. “But we

thought it was the best system. Today, everybody is selling points, so we were right.”

They kicked off the project in 1995 with a revised total of 92 two-bedroom,

two-bath units, each approximately 915 square feet (85 square meters), arranged

in five buildings. True to the partners’ vision, each unit had a lock-off, raising the

total number to 184. The developers held a grand opening in November 1997, and

welcomed the first owners the following year. “It was one of the few resorts in Chile

at that time that was built to be a timeshare,” Soza says. Materials and finishes were

selected with an eye toward their resilience and ability to hold up over time.

“Even after 20 years, you don’t notice that the resort is that old,” says David Toro

Herrera, the resort’s general manager. “We took special care to ensure the quality

would be long-term.”

Each unit has an ocean view, Soza adds. “We don’t have a first and a second class

here; all rooms have the front view.” In addition to breathtaking Pacific Ocean vistas,

APRIL – JUNE 2018

RESORTDEVELOPER.COMVACATION INDUSTRY REVIEW