Chinese tourists is up, and his company is looking at the best meth-

ods to reach them. “We have to have good salespeople who speak

the language and are knowledgeable about the product, as well as

materials in their language,” he says. “It will require a lot of invest-

ment, but we see the potential.”

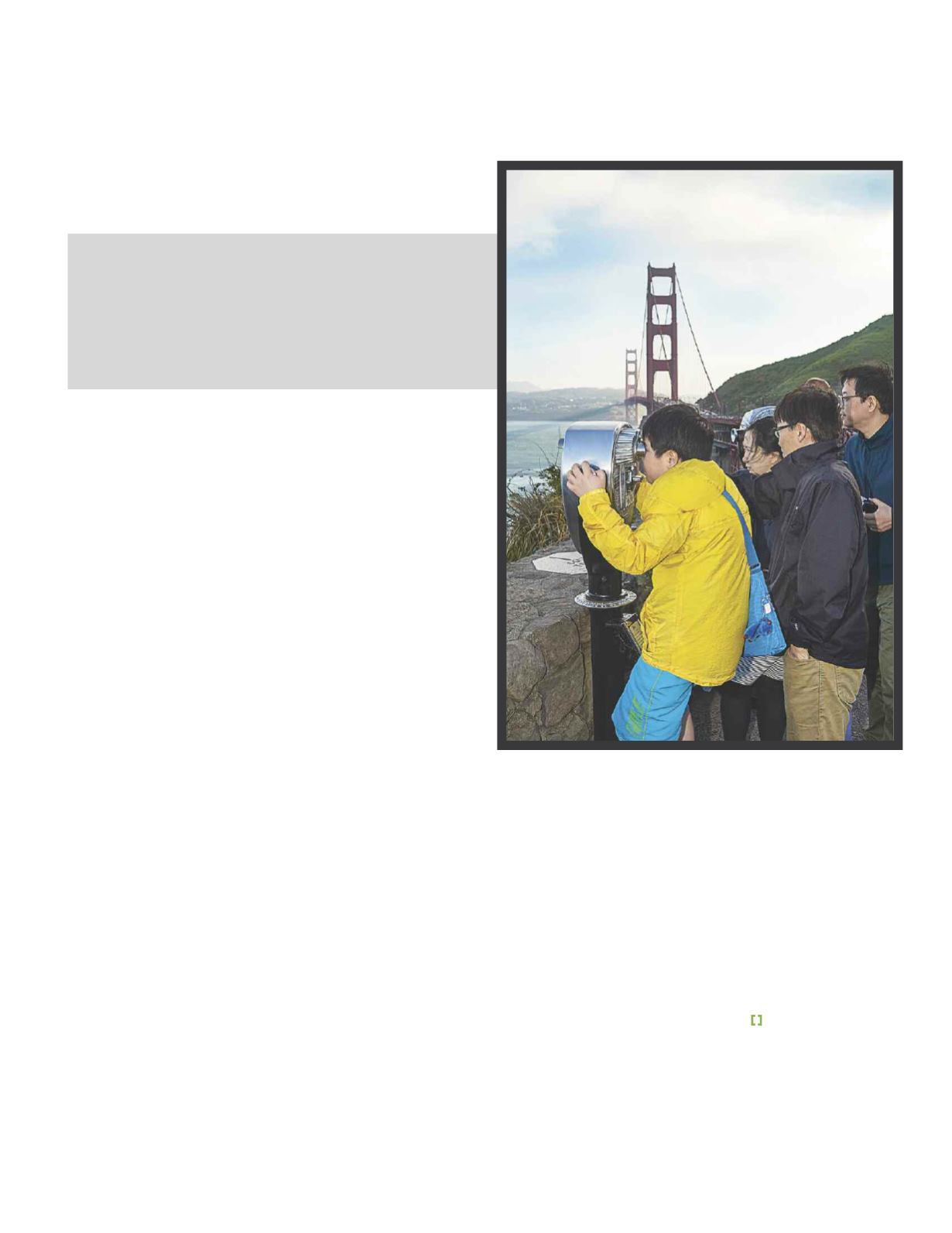

Urban destinations are most popular. “Major cities like Los Angeles,

San Francisco, and New York have more appeal,” Hickman says. A

recent survey of outbound tourists by China Confidential found that

Paris was their number-one dream destination and number-one for

planned visits in 2015, while Hong Kong was the most visited recently.

Phase II: Timeshare in China

Interval International has been making forays into the Chinese market

for more than a decade, even sponsoring Shared Ownership

Investment Conferences in Shanghai and Macau in 2006 and 2008. “If

phase one is marketing to Chinese tourists as they travel internationally,

then phase two will be establishing the vacation ownership industry

domestically,” says David C. Gilbert, Interval’s president.

But job one is establishing a constructive regulatory environment.

“In order to fuel growth, we need to strive for striking the right balance

between solid consumer protections and creating a healthy climate for

vacation ownership development,” Gilbert explains. Recently,

progress has been made on that front due to the efforts of an adjunct

group — spearheaded by Chinese conglomerate HNA Group — of the

China Association of Real Estate Developers. Interval and RCI are par-

ticipants in this endeavor.

Interval has also supported Florida International University’s

Chaplin School of Hospitality & Tourism Management’s satellite cam-

pus in Tianjin, China, which includes timesharing in its curriculum.

Begun in 2006, the program now has 300 new students each year,

and has graduated more than 1,100. International cruise lines and

companies such as Starbucks are providing scholarships and hiring

the graduates.

“We see a lot of opportunities for our graduates in vacation owner-

ship,” says Mike Hampton, the school’s dean.

Kane-Hanan, an FIU alumna, was also behind the school including

vacation ownership in its curriculum. “In addition to having the right

regulatory environment, we’re also going to need the requisite labor

force and infrastructure to build an industry,” she says.

Anantara has been a pioneer in the domestic Chinese market,

having opened an Anantara Vacation Club in Sanya and a 50-station

call center in its Shanghai operations office.

Caution Signs?

Signs that the Chinese economy is struggling can’t be ignored. But to

U.S. and European economists, the outlook remains positive. “GDP

growth is declining, meaning not growing as fast,” Freitag says. “Don’t

get me wrong, the numbers are still phenomenal. They’re just starting

to slow to sustainable levels.”

Albanese has the same impression. “There’s certainly some risk

with the overall economy, but 4 to 5 percent is still very big growth,” he

points out.

As Tolan sees it, the main takeaway is that China’s economic

growth has created a new class of consumer willing to travel outside

China. “It’s a very interesting dynamic,” he says. “Like most people

who are affluent, they’re very demanding. The companies and brands

that understand that will reap the benefits.”

See page 2 for currency conversions.

Judy Kenninger heads Kenninger Communications and has been covering

the shared-ownership and vacation real estate industries for nearly two

decades.

22

The main takeaway is that China’s

economic growth has created a new class of

consumer willing to travel outside China.